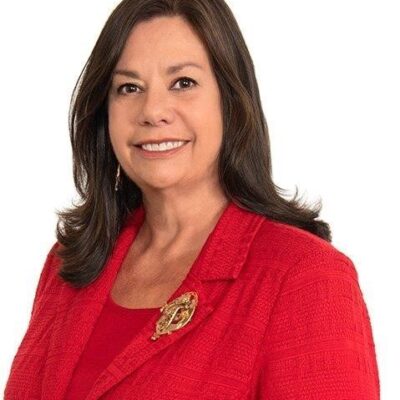

Anne E. Lazarus

Judge Anne E. Lazarus was born in Brooklyn, New York. She received a Bachelor of Arts degree in Psychology from the State University of New York at Stony Brook in 1972. She received both her Juris Doctor (1976) and LLM in Taxation (1986) from Temple University Beasley School of Law. …